Recently applied for the Krisflyer Ascend American Express credit card. The main reason I signed up for it was because of the additional 5,000 bonus Krisflyer miles that first time applicants would enjoy. It is given when one makes a first charge to the card.

In addition, one gets to enjoy bonus krisflyer miles in the first 3 months of usage. Of course, one thing to note is that the annual fee is waived for the first year. It is $256.80. The first two supplementary card fees are also waived.

The earn rate is 1 Krisflyer mile for every S$1.20 spent. It is not a lot. But the bonus miles do help.

Anyone cares to share the best way to earn Krisflyer points or airmiles?

Disclaimer: Credit cards are meant to be used responsibly. This article serves as a sharing piece. The reader is advised to check up on the relevant facts and figures for themselves.

This blog is about financial freedom and serves to inform, educate and entertain the public on all personal finance matters. The author of this blog has been blogging for 5 over years. He was also a guest blogger at CPF's IMSavvy site (now AreYouReady site). This blog is visited by many unique readers from various countries every month. Do bookmark this blog and leave your comments.

Pages

▼

Tisdale Merlot - Cheap and Good?

Bought a bottle of Tisdale Merlot and drank it over the week. The Californian wine was on offer at Cold Storage and was selling at slightly less than $14. So I grabbed it without hesitating though I know that those in the U.S. can probably get their hands on this Merlot for probably less than US$10.

Overall, I think the wine is a good everyday table wine. Taste of spices and some berry taste. It isn't particularly sweet but it is overall a good value wine for under $15. Seriously, I am no sommelier, so any wine under $15 is probably a steal for me.

Cold Storage is having some offers right now. So I bought another few bottles to try. Looks like I will have lots of wine to drink over the next few weeks.

In vino veritas.

Overall, I think the wine is a good everyday table wine. Taste of spices and some berry taste. It isn't particularly sweet but it is overall a good value wine for under $15. Seriously, I am no sommelier, so any wine under $15 is probably a steal for me.

Cold Storage is having some offers right now. So I bought another few bottles to try. Looks like I will have lots of wine to drink over the next few weeks.

In vino veritas.

More Money, Less Stress

Lately, I have taken a more laid back approach to my investing. I have been focused on funds/ETFs that give dividends and have taken the approach of just buying regular amounts each month. There is less impetus to check the stock market, so very much less stress involved. Some of these funds also give monthly dividends and thus, I get the benefit of having some passive income. In short, more money and less stress.

This is just a short post to let everyone know that I am fine. I hope to go back to regular posting soon. This blog is still marching its way slowly towards 600,000 pageviews without me doing anything.

Life is simple. I eat 3 meals a day. Enjoy my time at home. Been reading. Sleeping early and waking up early. I feel totally blessed. Savouring each moment of the day.

Two words in my mind: Blessed and Passion.

I feel so blessed to be where I am, living the life that I want to. All the comforts that I enjoy today were probably not around 100 years ago. In fact, these comforts are not available to many people in different parts of the world today. So I do feel supremely and amazingly blessed with everything that I have. A bed to sleep in, food to eat, water to drink and a beautiful/peaceful country to live in. Our generation in Singapore is perhaps so blessed that we forget to give thanks for it.

Passion. What is my passion? This is the thought that has been bugging me. Can I live off my passion?

This is just a short post to let everyone know that I am fine. I hope to go back to regular posting soon. This blog is still marching its way slowly towards 600,000 pageviews without me doing anything.

Life is simple. I eat 3 meals a day. Enjoy my time at home. Been reading. Sleeping early and waking up early. I feel totally blessed. Savouring each moment of the day.

Two words in my mind: Blessed and Passion.

I feel so blessed to be where I am, living the life that I want to. All the comforts that I enjoy today were probably not around 100 years ago. In fact, these comforts are not available to many people in different parts of the world today. So I do feel supremely and amazingly blessed with everything that I have. A bed to sleep in, food to eat, water to drink and a beautiful/peaceful country to live in. Our generation in Singapore is perhaps so blessed that we forget to give thanks for it.

Passion. What is my passion? This is the thought that has been bugging me. Can I live off my passion?

One Question That Will Change Your Life

If there is one question that can change your life, it will probably be whether you are passionate about whatever you are doing in life. Steve Jobs sums it up real nicely in this short video. People who succeed are those who are passionate in what they are doing. Why else would they be able to keep doing things at their peak level on a sustained basis? And therein lies the secret of success.

As he also sums up nicely in this quote:

"For the past 33 years, I have looked in the mirror every morning and asked myself: "If today were the last day of my life, would I want to do what I am about to do today?" And whenever the answer has been "No" for too many days in a row, I know I need to change something..almost everything - all external expectations, all pride, all fear of embarrassment or failure - these things just fall away in the face of death, leaving only what is truly important. Remembering that you are going to dies is the best way I know to avoid the trap of thinking you have something to lose."

For the past few days, I have been asking myself what am I really passionate about in life. And I think I have drilled it down to three things : Travelling, reading and writing.

Travelling because this is the activity that makes me feel alive. My sense are keener and more aware of my surroundings. I feel excited about every single sight and sound that I experience. It is only during my travels that I truly feel alive and living.

Reading because through reading, I get to experience the viewpoints of others. I get lost in their world. I learn from the experience of others. I share their joy, mistakes, pain, etc. Things that I will never have been able to experience for myself.

Writing because it is the only creative expression of myself. I am not talented musically or with any other kind of handicraft. Yet, I have always viewed myself as someone who likes to create things. And writing is something that I enjoy doing. It allows me to consolidate my thoughts, reflect on my innermost fears and desires. And to express them into words concretises whatever I am thinking.

Dividends for July 2013

Received 4 cheques in the mailbox for this month.

Cheque #1 = $13.03

Cheque #2 = $50.59

Cheque #3 = $87.54

Cheque #4 = $69.07

All the cheques were from U.S. stocks that I own. Have not been keeping a good record of all the dividends that I have been receiving each month so thought that I should just log this down before I forget.

Overall, my portfolio has changed quite a bit. Many of the higher yielding stocks that I bought have had bad news lately which has affected the value of my portfolio. At the same time, I am fortunate to have exited quite a fair bit of my stocks during their recent highs. So there is quite a bit of free cash left to invest.

Financially, I will like to think that I am progressing fine. There are surpluses each month to invest/save and that is sufficient. Have been spending more time reading, reflecting and living each day to the fullest. Life is too short to worry about tomorrows.

Hopefully all readers had a very good long weekend. It was a well deserved break for me too.

Cheque #1 = $13.03

Cheque #2 = $50.59

Cheque #3 = $87.54

Cheque #4 = $69.07

All the cheques were from U.S. stocks that I own. Have not been keeping a good record of all the dividends that I have been receiving each month so thought that I should just log this down before I forget.

Overall, my portfolio has changed quite a bit. Many of the higher yielding stocks that I bought have had bad news lately which has affected the value of my portfolio. At the same time, I am fortunate to have exited quite a fair bit of my stocks during their recent highs. So there is quite a bit of free cash left to invest.

Financially, I will like to think that I am progressing fine. There are surpluses each month to invest/save and that is sufficient. Have been spending more time reading, reflecting and living each day to the fullest. Life is too short to worry about tomorrows.

Hopefully all readers had a very good long weekend. It was a well deserved break for me too.

Card Trick That Fools Penn and Teller

Penn and Teller are great magicians. So when a card trick leaves them stunned or mystified, you can be certain that it is a really good trick. See how this magician leaves both of them puzzled in the Penn and Teller show.

How do you think this trick was done?

How do you think this trick was done?

Cut In Half Magic Trick

This is the cut in half prank done by a magician. See how he scares everyone. Believe that the first one who invented this trick was David Copperfield. But I could be wrong. Anyone knows how this trick is done? It is actually quite simple. The person is basically in a sitting position and the clothes are specially made. At least that is what I think.

Caboki - Amazing Hair Loss Concealer Video. "Grow" Hair in Seconds

Wow. I must admit that this is the first time I have seen such a product. This is a hair loss concealer powder. It does not stop hair loss or promote hair growth. What it does is conceal hair loss. It is akin to mascara except that it is used on the head. So one needs to have some hair left for this to work. Watching the video, I must say that I am pretty impressed at the results. This looks like an effective hair loss concealer especially for those with balding spots.

Babies Trained in the Art of Escaping

Check out this video of babies that are escaping from their cribs, etc. Really enjoyable to watch.

Jeff Gundlach on Japan, Apple and Bubbles

Jeffrey Gundlach, the new "bond king", shares with Reuters some wealth strategies and gives his take on Japan, Apple and bubbles.

Marina Bay Sands Wedding

Marina Bay Sands is huge. Especially their convention centre where all the ballrooms are located. It is no wonder that many people have been having their weddings at Marina Bay Sands. Well, it seems that based on their wedding package, there are various options for a Chinese wedding banquet. The prices don't come cheap though and start from $1088+ per table to $1388+ per table (depending on the choice of dishes).

So if you are attending a wedding dinner there, you know the "market rate" to give. Simply divide the price by 10 and don't forget that the price does not include service charge and GST.

In terms of location, I think Marina Bay Sands is great. Ample parking spaces and also easily accessible by MRT. Complimentary parking tickets are usually given out.

The view is also stunning though it is not observable from the ballrooms itself. One will have to walk out to see the view. Furthermore, people can sneak out for a short break or even to go shopping if they want to!

Food-wise, I will rate it as above average. The food is good but I won't say that it is spectacular or anything. It is of a reasonable standards.

The service is average or even below average. Nowadays, it is really difficult to find good service in Singapore.

So if you are attending a wedding dinner there, you know the "market rate" to give. Simply divide the price by 10 and don't forget that the price does not include service charge and GST.

In terms of location, I think Marina Bay Sands is great. Ample parking spaces and also easily accessible by MRT. Complimentary parking tickets are usually given out.

The view is also stunning though it is not observable from the ballrooms itself. One will have to walk out to see the view. Furthermore, people can sneak out for a short break or even to go shopping if they want to!

Food-wise, I will rate it as above average. The food is good but I won't say that it is spectacular or anything. It is of a reasonable standards.

The service is average or even below average. Nowadays, it is really difficult to find good service in Singapore.

Treat Hair Loss with Onion?

Okay, I was searching the internet about natural treatments for hair loss when I came across this short video that claims one can use onions to treat hair loss. I wonder whether anyone has ever tried this before. Won't you stink if you rub onion on your scalp. Not for the faint hearted definitely.

Another video here also shows a DIY hair loss treatment using onions too. If anyone ever tries this and it works, do let all of us know. I am sure those of us who are balding or losing hair will gladly give it a shot.

Dog Gets Shot By Police

A dog gets shot by the police after it tries to protect its owner. Disturbing footages if you are a dog owner.

Dividends for May 2013

Phew! It has been some time since I last wrote. Was too busy and just could not find the time to sit down and pen anything.

Anyway, dividends received in the month of May 2013 wasn't too bad. This was helped by monthly dividend stocks in my holdings such as Armour Residential REIT (ARR) and GAMCO Global Gold and Natural Resources Trust (GGN). I also received payout from BDCL (a ETN that pays quarterly dividends). The amounts I received is probably close to $200. I am not keeping good records and I might have bank in some cheques that were actually sent to me much earlier in April.

From Singapore shares, I have also collected dividends to a neat tune of $500 exactly. Cool and not bad for a month.

I also bought into Fidelity Asian High Yield Fund through DBS. It is a unit trust that pays out monthly dividends and I can choose to receive the dividends or reinvest it. Received around $7 from this unit trust.

That's all for now.

And guess what? This blog has garnered more than half a million views. Cool eh?

Anyway, dividends received in the month of May 2013 wasn't too bad. This was helped by monthly dividend stocks in my holdings such as Armour Residential REIT (ARR) and GAMCO Global Gold and Natural Resources Trust (GGN). I also received payout from BDCL (a ETN that pays quarterly dividends). The amounts I received is probably close to $200. I am not keeping good records and I might have bank in some cheques that were actually sent to me much earlier in April.

From Singapore shares, I have also collected dividends to a neat tune of $500 exactly. Cool and not bad for a month.

I also bought into Fidelity Asian High Yield Fund through DBS. It is a unit trust that pays out monthly dividends and I can choose to receive the dividends or reinvest it. Received around $7 from this unit trust.

That's all for now.

And guess what? This blog has garnered more than half a million views. Cool eh?

Avoiding Credit Card Fraud

Using a credit card gives you the

opportunity to build your credit profile and increase your purchasing power. While

credit cards definitely have some advantages over other methods of payment,

they are sometimes susceptible to fraud. If you become the victim of credit

card fraud, it can be a particularly frustrating experience. Here are a few

things to consider about credit card fraud and how to avoid it.

How it Works

It doesn't take much for someone to try to take advantage of you through credit card fraud. All a thief needs is the information off of your credit card, and then they can start making purchases online.

Another version of credit card fraud occurs when someone gets your personal information and then opens a credit card account in your name. At that point, then the individual can use the new credit card that they get from the credit card provider to make purchases.

Avoiding Fraud

One of the nice things about many Singapore credit cards is that they have anti-fraud features. If someone uses your card to make a fraudulent purchase, then you can call the credit card company and notify them. Many of these cards will simply take off the charge and you won't be responsible for it.

You also have to be careful where you use your card. Never give it to anyone to take out of your sight, such as at a restaurant. You also need to look carefully at any ATM that you put your card into. Some scam artists use a technique called skimming to scan your credit card information once it goes into the ATM. Make sure that there haven't been any modifications to the slot.

Also, you should never email your credit card information to anyone who asks for it. Use a secure order form only.

Check Your Credit Report

If you are concerned with the possibility of someone opening a credit card in your name, it's a good idea to check your credit report regularly. When you get your credit report, you can see what accounts you have open in your name. If anyone has opened an account in your name, you'll be able to see it on your credit report.

How to Avoid the Problem

If you are interested in avoiding this problem altogether, you need to safeguard your information at all times. Don't throw your credit card statements or personal records out in the trash without shredding them. If you are getting your credit card out to make a purchase, make sure that you keep it covered at all times so that no one will be able to see the information off of it or your PIN.

Considerations

Although credit card fraud is definitely a big problem in the world today, you can minimize the chances of any damage by taking a few simple steps. If you take the time to keep your information safe, you'll be at a much lower likelihood of risk in the future. When choosing a credit card, you should also make sure that you pick one that has a zero liability for fraud policy. This way, you can ensure that you're never paying for fraud out of your own pocket.

Is Gold and Silver Still a Buy?

Earlier in February this year, I wrote a short post on whether it was the end of the gold bull run. Of course, I couldn't say for certain that the bull run in gold was going to end. After all, there are renowned investors out there who were still bullish in gold for the long term. I wrote a more balanced post on some reasons to buy gold or silver. After all, investing in gold is something that most serious investors will consider doing as part of their asset allocation.

For those who have been monitoring the gold and silver spot prices, you should be aware that gold and silver prices dropped drastically in yesterday's trading. Gold ETFs like SPDR Gold (Ticker: GLD) fell by almost 10% in a single day with hedge funds rumoured to have started the huge sell off. Well, a correction was more or less expected since billionaire Jim Rogers (who now lives in Singapore) said that a correction was due. In fact, Jim Rogers believes that gold prices will head towards US$1200/oz. He will probably start buying at that level.

But is this more than a correction? Because it seems that we are now in a bear market for gold and silver. Worries about inflation in the United States with all the money printing through the quantitative easing programs seems to be unfounded. Inflation remains low to this day. And besides, the stock market has been roaring on for quite a few months. So investors in gold and silver have probably missed out on the bull run in the stock market and are taking the opportunity to liquidate their holdings since the supposed dollar crisis/crash has failed to occur. Many traders probably closed their positions too especially if they bought at the highs of US$1800-$1900/oz.

Is gold and silver still a buy? It probably is. But one will probably have to wait for the right price. And also be reminded that unlike stocks, gold and silver do not provide any form of cash flow or dividends. It is almost simply a store of value and a hedge against hyperinflation or "catastrophic" events. Could this be the reason why Warren Buffet is negative on gold?

For those who have been monitoring the gold and silver spot prices, you should be aware that gold and silver prices dropped drastically in yesterday's trading. Gold ETFs like SPDR Gold (Ticker: GLD) fell by almost 10% in a single day with hedge funds rumoured to have started the huge sell off. Well, a correction was more or less expected since billionaire Jim Rogers (who now lives in Singapore) said that a correction was due. In fact, Jim Rogers believes that gold prices will head towards US$1200/oz. He will probably start buying at that level.

But is this more than a correction? Because it seems that we are now in a bear market for gold and silver. Worries about inflation in the United States with all the money printing through the quantitative easing programs seems to be unfounded. Inflation remains low to this day. And besides, the stock market has been roaring on for quite a few months. So investors in gold and silver have probably missed out on the bull run in the stock market and are taking the opportunity to liquidate their holdings since the supposed dollar crisis/crash has failed to occur. Many traders probably closed their positions too especially if they bought at the highs of US$1800-$1900/oz.

Is gold and silver still a buy? It probably is. But one will probably have to wait for the right price. And also be reminded that unlike stocks, gold and silver do not provide any form of cash flow or dividends. It is almost simply a store of value and a hedge against hyperinflation or "catastrophic" events. Could this be the reason why Warren Buffet is negative on gold?

Bought Nam Cheong Again

I previously did a trade on Nam Cheong and made some small gains. Lately, I have entered into another position into Nam Cheong since I think that the stock has potentially more upside. My entry price is at $0.25. Nam Cheong has also announced dividends of $0.005 per share. OCBC has a fair value estimate of $0.30 for this stock but I think I will probably sell it if it rises by 10%. That sets my own rget price of Nam Cheong at around $0.275 to $0.28.

Vested interest. Please do your own due diligence.

Vested interest. Please do your own due diligence.

Random Thoughts

These are all random thoughts that I have been having the past few days. The first is really about my investing philosophy. I slowly come to realise that after reading so many books on investing, I am not really certain which school of thought I belong to.

Are markets efficient or are they inefficient? Should I just do index investing as suggested by gurus like Bogle or is it possible that one can actually find good stocks like Warren Buffett. And that is also about finding good stocks beyond what is considered luck or statistically insignificant results. But if you invest in the market index, then during the bear markets, it will also mean that you perform as badly as the entire stock market. And that by itself is a scary thought.

Another area is capital appreciation or dividends. Should I work towards building up a greater sum of capital first before going into dividend investing? Really mixed thoughts about this. For every attempt at capital appreciation, one is almost certain to introduce risks and possible losses to capital.

Is the bull market here to stay or is there going to be a coming collapse?

Will gold and silver continue to shine?

Will Greece still be in the Euro?

Will the US dollar continue to depreciate?

Is the US stock market rally justified by fundamentals? Or is it just another bubble?

When will the China bubble collapse?

Random thoughts in my head with no answers....

Are markets efficient or are they inefficient? Should I just do index investing as suggested by gurus like Bogle or is it possible that one can actually find good stocks like Warren Buffett. And that is also about finding good stocks beyond what is considered luck or statistically insignificant results. But if you invest in the market index, then during the bear markets, it will also mean that you perform as badly as the entire stock market. And that by itself is a scary thought.

Another area is capital appreciation or dividends. Should I work towards building up a greater sum of capital first before going into dividend investing? Really mixed thoughts about this. For every attempt at capital appreciation, one is almost certain to introduce risks and possible losses to capital.

Is the bull market here to stay or is there going to be a coming collapse?

Will gold and silver continue to shine?

Will Greece still be in the Euro?

Will the US dollar continue to depreciate?

Is the US stock market rally justified by fundamentals? Or is it just another bubble?

When will the China bubble collapse?

Random thoughts in my head with no answers....

Do You Know What Are Home Loan Consultancy Sites?

By Property Buyer

Working procedures of online home loan consultancy in Singapore:

1. What do mortgage consultants do?

Home loan consultants work by providing the requirements and information about the home loan packages offered by different banks in the country. They act like a medium between you and the financial institution which will provide your home loan.

In the beginning, they will take your overall details and assess your financial profile to suggest the most suitable home loan as they are knowledgeable about all the different Singapore home loans available.

Home loan consultants provide this free service as they are paid a percentage of the loan amount from the bank itself.

The banks in Singapore maintain this relationship with home loan consultants because they get to save on sales staff.

2. Different online home loan packages

Some of the home loan consultancy sites offer you different comparison tools to compare the home loan packages from different banks , or the same bank. I have a great exemplary site which can provide you this service apart from the usual mortgage advisory services.

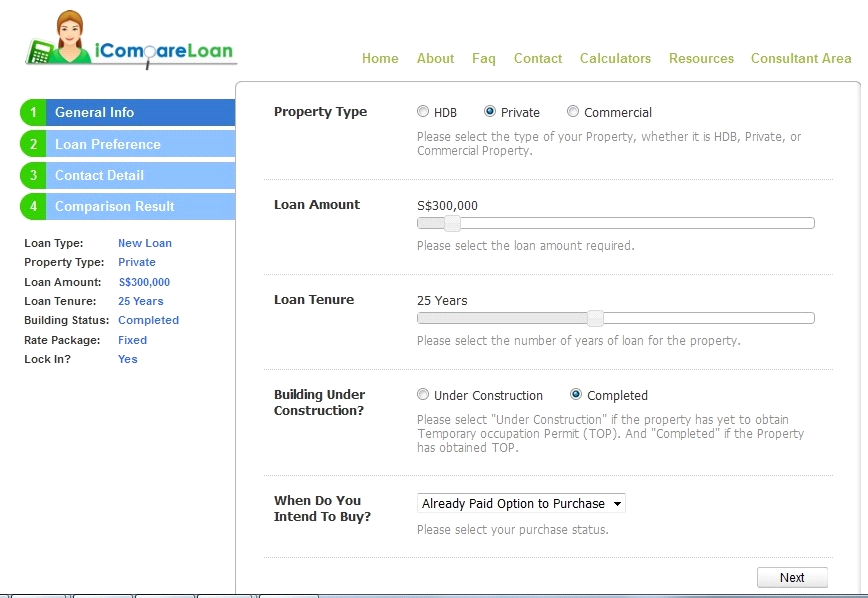

The home loan comparison system at iCompareLoan.com perform that in 4 easy steps only. Before that, you need to provide some important information such as:

- Quantum

- Duration

- Type (fixed or floating rate)

The whole process is illustrated in figure 1 and figure 2 as follows:

Source: www.iCompareLoan.com/new_loan

3. Desired reports for your home loan

Figure 1: Step 1 of Loan Comparison System

Source: www.iCompareLoan.com/new_loan

Figure 2: Step 4 of Loan Comparison System

Source: www.iCompareLoan.com/new_loan

3. Desired reports for your home loan

A home loan report shows the comparative information about the different Singapore home loans formalities and requirements for different banks of Singapore. These reports are provided by a few home loan consultancy sites like iCompareLoan.com , which offers a loan analysis system. This service is almost free or given for a small fee and it is the most advanced in Singapore. This analytical system can generate very helpful reports by comparing many home loan packages. In these reports there are included various information such as interest cost savings from refinancing or new loans, building-under-construction loans, amortization tables, and so on.

You can see the log-in page in Figure 3:

Figure 3: Loan Analysis System

Source: www.iCompareLoan.com/consultant/

Benefits of home loan consultancy sites:

1. Save time and effort

How can home loan consultancy sites make life different for you? The answer is that they can save you valuable time and effort. In Singapore there are over 16 banks that can provide a mortgage. Together they have almost 50 types of loan packages to offer. Now, if you are thinking about inquiring each and every home loan package then you have to visit each bank website. But, more often than, you will not be able to find the most basic information about the loan on these sites. Not even the interest rates or the lock-in period.

Rather these sites will direct you to their bank officers for further details ; thus you have to speak with over 10 officers to find the most suitable mortgage. In this case, home loan consultancy sites can help you sift through all the packages and compare their features in easy-to-read tables.

Through the free DIY loan comparison tools, provided by consultancy sites as well as by iCompareloan.com , you can generate tables comparing the main features of various loan packages. This can be achieved with only a few simple steps saving you plenty of time and effort.

For more comprehensive advice you can contact the mortgage consultants as the loan packages and their features can change ever so often.

For a borrower it can be difficult to be constantly aware of all the changes. A mortgage consultant, on the hand, is well aware of all the changes as it is his job.

2. Unbiased loan advice

Before you decide to take a mortgage from any bank you need unbiased advice about the offers of different banks. This information can only be provided by mortgage consultants as they are not beholden to any single bank. On the other hand, if you seek advice from a bank officer he will try to convince you about the merits of the loans offered by his bank. He also cannot provide you with information about other banks' loans.

So, the best advisors are the mortgage consultants who know enough to provide information.

3. Extra assistance

Home loan consultants not only can provide you with information about the various different loans, but they can even assist to make an application for your desired mortgage. They are happy to assist you in putting in order the required documents for the loan application. As the paperwork can take up a lot of time so your loan application can be delayed too.

When the loan amount is over $2 million, mortgage consultants can even negotiate a good interest rate during the approval process.

About Property Buyer

http://www.PropertyBuyer.com.sg/mortgage

We are a research-focused Singapore mortgage consultancy which helps you compare Singapore home loans either for new loans or refinancing. We use loan reports from Singapore's best loan analysis system (exclusive to us) at http://www.icompareloan.com/consultant/ to serve our customers.

Our services are completely FREE to you as the banks pay us a referral fee upon loan disbursement.

SMS: (65) 9782 8606

Email: loans@PropertyBuyer.com.sg

Join us at Facebook:

www.facebook.com/iCompareLoans

www.facebook.com/SGpropertyBuyer

www.facebook.com/sghomeloan

Simply Bread Breakfast

Breakfast was at Simply Bread again. It was a rather relaxing day with little appointments to keep up with so there was time for a nice and slow meal. Tucked away between 5th Avenue and 6th Avenue, the location is perfect. Not too far flung yet secluded enough and away from the crowds. A respite from your usual shopping malls.

The crowd is a mixture of Caucasians and Singaporeans (or Asians). Everybody seems to be ordering 2 Eggs but that is not what I ordered. French Toast with Ham Steaks is on my mind.

Their french toast is not your typical thin sliced bread soaked in egg mixture. It is something I haven't tried elsewhere.

The ham steaks are as always - GOOD. Comfort food at its best. Thick slices of honey baked ham with some honey drizzled over it. Well, that set me back by ten dollars and cents thirty-five (GST not included). But whose counting?

And the meal was made complete with the usual cup of coffee and milk. =)

The crowd is a mixture of Caucasians and Singaporeans (or Asians). Everybody seems to be ordering 2 Eggs but that is not what I ordered. French Toast with Ham Steaks is on my mind.

Their french toast is not your typical thin sliced bread soaked in egg mixture. It is something I haven't tried elsewhere.

The ham steaks are as always - GOOD. Comfort food at its best. Thick slices of honey baked ham with some honey drizzled over it. Well, that set me back by ten dollars and cents thirty-five (GST not included). But whose counting?

And the meal was made complete with the usual cup of coffee and milk. =)

Aston Martin V12 Vantage

Top Gear tests drives the Aston Martin V12 Vantage. It goes from 0 to 60 miles in 4 seconds. While it looks like the V8 Vantage, it is really a lot more powerful.

Dividends and Passive Income for Jan and Feb 2013

I have been keeping a very bad record of my dividends/passive income. But here it is so that I do not forget:

Jan 2013: $111.80

Feb 2013: $287.46

Main contributors were from Armour Residential REIT (ARR), GAMCO Gold and Natural Resources Trust (GGN), and Starhill Global REIT.

I have also liquidated quite a few of my stocks. On the back of STI hitting its 5 year high, I have sold off all my holdings in Ascott REIT, Saizen REIT, LMIR, Thakral, Nam Cheong and Citigroup.

Jan 2013: $111.80

Feb 2013: $287.46

Main contributors were from Armour Residential REIT (ARR), GAMCO Gold and Natural Resources Trust (GGN), and Starhill Global REIT.

I have also liquidated quite a few of my stocks. On the back of STI hitting its 5 year high, I have sold off all my holdings in Ascott REIT, Saizen REIT, LMIR, Thakral, Nam Cheong and Citigroup.

Poor People in Singapore

There are poor people in Singapore. The poor are really poor and the rich are really rich. And the divide is probably getting larger. The median monthly household income from work amongst resident employed household for year 2012 was S$7,570. This includes employer Central Provident Fund contributions. Based on statistics, there are 9.2% of households with no working persons, of which, 6.0% of these are retiree households.

I have become more aware of the poor around us. At least to me, I have been noticing that there are more and more people walking (or standing) around selling tissue papers. Well, they are not really selling tissue papers are they? Some of them just place the tissue papers on your table while you are eating and ask you for money. They are almost literally begging for money. The selling of tissue paper is just a "cover". After all, begging is illegal in Singapore(?).

One also notices that there are people who are selling tissue papers outside supermarkets, grocery stores, etc. Anybody in need of a tissue paper can easily pop into one of those stores to buy themselves all the tissue they need. But yet, it is not uncommon to see people stopping to buy tissue paper from these poor people who peddle their wares.

It is also increasingly common to see homeless people sleeping around in the void decks or at various places in Singapore. Well, these people might not be homeless. But nobody really knows. And nobody bothers to ask.

Just today, I witnessed a woman go up to some diners to ask for money to buy food. It might come as a surprise to some but I have actually seen people eating left over food on the tables as well as from the dustbins. Yes, we can dismiss them as perhaps mentally unsound. But perhaps the reason is that they are really poor.

There is also this struggle within me about how to help the poor. I struggle with it every now and then. Surely change must begin with me. But there are limits to how much I can do. Or perhaps, these are just my excuses.

I have become more aware of the poor around us. At least to me, I have been noticing that there are more and more people walking (or standing) around selling tissue papers. Well, they are not really selling tissue papers are they? Some of them just place the tissue papers on your table while you are eating and ask you for money. They are almost literally begging for money. The selling of tissue paper is just a "cover". After all, begging is illegal in Singapore(?).

One also notices that there are people who are selling tissue papers outside supermarkets, grocery stores, etc. Anybody in need of a tissue paper can easily pop into one of those stores to buy themselves all the tissue they need. But yet, it is not uncommon to see people stopping to buy tissue paper from these poor people who peddle their wares.

It is also increasingly common to see homeless people sleeping around in the void decks or at various places in Singapore. Well, these people might not be homeless. But nobody really knows. And nobody bothers to ask.

Just today, I witnessed a woman go up to some diners to ask for money to buy food. It might come as a surprise to some but I have actually seen people eating left over food on the tables as well as from the dustbins. Yes, we can dismiss them as perhaps mentally unsound. But perhaps the reason is that they are really poor.

There is also this struggle within me about how to help the poor. I struggle with it every now and then. Surely change must begin with me. But there are limits to how much I can do. Or perhaps, these are just my excuses.

Make Their Wishes Come True

Dear Readers,

Have started a donation campaign to raise $10,000 for Make A Wish Foundation. Make A Wish Foundation (Singapore). The target is $10,000 to be achieved by the end of this year.

For those who might not know, make a wish foundation tries to fulfil the wishes of children who suffer from life-threatening medical conditions. Think of what you can do just to put a smile on their faces.

If you have enjoyed reading this blog in one way or another, please make a little donation to support this worthy cause. Any small amount, no matter how little, will do.

Thank you.

Have started a donation campaign to raise $10,000 for Make A Wish Foundation. Make A Wish Foundation (Singapore). The target is $10,000 to be achieved by the end of this year.

For those who might not know, make a wish foundation tries to fulfil the wishes of children who suffer from life-threatening medical conditions. Think of what you can do just to put a smile on their faces.

If you have enjoyed reading this blog in one way or another, please make a little donation to support this worthy cause. Any small amount, no matter how little, will do.

Thank you.

Reasons to Buy Gold or Silver

Gold and silver seem to be back to their 2011 levels. iShare Silver Trust (SLV) is trading at $28.41 while SPDR Gold Trust (GLD) is trading at $156.22. Well, gold and silver spot price are also trading around $1600/oz and $29/oz respectively. The talking heads at Bloomberg and CNBC are all now suggesting that it might be the end of the gold bull run. After writing the earlier posting yesterday, I thought about it and decided that perhaps a more balanced view ought to be presented.

So in this posting, I will throw up some of the reasons to continue buying gold or silver.

Firstly, the world's central banks are now net buyers of gold, purchasing gold like never seen before. According to the World Gold Council, central banks accounted for 12% of total demand for gold in 2012. The demand for silver also seems to be rising and the supply does not seem to be able to keep up (at least that is what the silver bugs' charts are telling us).

Secondly, with all the money printing by the Feds, inflation is almost certain. Gold and silver are thus a good hedge against inflation since many view them as the true store of value. Many of these proponents are also predicting that the dollar will soon crash and that somehow, someday, the entire world will go back to the gold standard.

Thirdly, while the prices of gold and silver might have corrected a fair bit for this year, the global outlook still looks uncertain. The US debt is reaching alarming levels, Europe crisis, etc. So it is not surprising that people are bullish on these 2 metals since they seem to have a negative correlation to the overall stock market/economy.

In any case, the people who argue for investing in gold or silver are still sticking to their guns that another bull run is in the making. Will they be correct?

So in this posting, I will throw up some of the reasons to continue buying gold or silver.

Firstly, the world's central banks are now net buyers of gold, purchasing gold like never seen before. According to the World Gold Council, central banks accounted for 12% of total demand for gold in 2012. The demand for silver also seems to be rising and the supply does not seem to be able to keep up (at least that is what the silver bugs' charts are telling us).

Secondly, with all the money printing by the Feds, inflation is almost certain. Gold and silver are thus a good hedge against inflation since many view them as the true store of value. Many of these proponents are also predicting that the dollar will soon crash and that somehow, someday, the entire world will go back to the gold standard.

Thirdly, while the prices of gold and silver might have corrected a fair bit for this year, the global outlook still looks uncertain. The US debt is reaching alarming levels, Europe crisis, etc. So it is not surprising that people are bullish on these 2 metals since they seem to have a negative correlation to the overall stock market/economy.

In any case, the people who argue for investing in gold or silver are still sticking to their guns that another bull run is in the making. Will they be correct?

Gangnam Style - Jayesslee

This is another really cool version of Gangnam Style done by Jayesslee. I believe that they are sisters. Really nice and some what similar to the acoustic version of Gangnam Style done by Steph Micayle

The End of the Gold Bull Run?

Is this the end of the bull run for gold which has seen a meteoric rise over the past years. Goldman Sachs has a 12 month forecast of $1,550/oz. Gold has dropped 5 percent from the start of the year with investors like George Soros also cutting down his gold holdings. Of course, one would be wise to heed the Warren Buffet's take on gold (even though it might be dated). Many have also called gold the ultimate bubble while others are still quite bullish on this precious metal. But with the US printing money with a vengeance, it is little wonder why many would want some kind of hedge against inflation.

Gold had hit an all-time high in Sept 2011 of slightly over $1920/oz. Today, gold spot price is at $1597/oz.

Gold had hit an all-time high in Sept 2011 of slightly over $1920/oz. Today, gold spot price is at $1597/oz.

Burger Taste Test : Beef or Horse

So the latest news on the horse meat scandal is that IKEA's meatballs have been implicated too. Well, there is no idea yet whether Singapore has been affected. Anyway, here is a burger taste test video.

Thierry Henry Returning to Arsenal

Thierry Henry looks like he could be returning to Arsenal for his third stint. The Frenchman has a close relationship with Arsenal manager Arsene Wenger and is also Arsenal's all-time record goalscorer. He has scored 226 goals during 1999 to 2007 and 2 goals during his loan spell from New York Red Bulls last season.

Henry's deal is set to expire soon and rumours seems to suggest that he could be set for a return to the Emirates.

Henry's deal is set to expire soon and rumours seems to suggest that he could be set for a return to the Emirates.

Beatrice Miller - Titanium

A really nice Judge's House song by X Factor 2012 (USA) contestant, Beatrice Miller, who sang the song Titanium by David Guetta. I liked her style and the of course the background of the judge's house. Stunningly beautiful.

Well, if you like her voice, then be sure to check out her song that she performed with Carly Rose Sonenclar at Bootcamp. Well, Carly Rose Sonenclar is another ultra talented girl with an amazing voice who can sing real well. Check out her song at the judge's house as well as her audition song.

Quip.com

What is Quip.com? Well, Bret Taylor who used to be CTO for Facebook left the company last year and is currently the CEO of Quip.com. And it is currently a stealth start-up because nobody knows what it is meant to do.

Taylor is working on this project together with a former Googler Kevin Gibbs. And they are not releasing any information on it yet. So could this secretive project turn out to be the next Facebook or Google?

Well, details are certainly lacking at the moment. Hitting quip.com in your url will just bring you to a google accounts login page. And that does not tell much. But some people are guessing that it could be something to do with editing of documents.

Well, a quip is to make a witty remark. And it could also mean a joke. So perhaps quip.com is something like Facebook and allows people to make witty remarks on webpages as they surf the net. I am just trying to guess here. But only time will tell.

Taylor is working on this project together with a former Googler Kevin Gibbs. And they are not releasing any information on it yet. So could this secretive project turn out to be the next Facebook or Google?

Well, details are certainly lacking at the moment. Hitting quip.com in your url will just bring you to a google accounts login page. And that does not tell much. But some people are guessing that it could be something to do with editing of documents.

Well, a quip is to make a witty remark. And it could also mean a joke. So perhaps quip.com is something like Facebook and allows people to make witty remarks on webpages as they surf the net. I am just trying to guess here. But only time will tell.

Not Just Simply Bread

There are many places one can enjoy a nice, leisurely breakfast in Singapore. And Simply Bread is perhaps one of those places. Well, it doesn't just serve bread alone (as much as its name seems to suggest). Simply Bread has two outlets. One is at Guthrie House (located along 5th Avenue) and the other is at Cluny Court (just opposite the Botanical Gardens MRT station).

One item on the menu is the Two Eggs (choose how you like your eggs to be done - sunny side up, scrambled, omelette). And of course, there are also the brunch plates like Honey Ham.

Check out my previous postings about Best Breakfast Places in Singapore and Best Breakfast Places in Singapore (Part 2).

One item on the menu is the Two Eggs (choose how you like your eggs to be done - sunny side up, scrambled, omelette). And of course, there are also the brunch plates like Honey Ham.

Check out my previous postings about Best Breakfast Places in Singapore and Best Breakfast Places in Singapore (Part 2).

Sold Off Nam Cheong

I have been watching Nam Cheong keenly as I mentioned that it was one of the 3 stocks on my watchlist. I wrote about Nam Cheong poised to breakout few weeks back. Have sold it off on Friday after having some small gains. The charts still look positive (at least to me). But I am no longer vested in it since my target price has been reached.

Sold Off Citigroup

I sold off my entire stake in Citigroup at a price of around US$44.11 last week. My average entry price for the stock was US$37.00. After some thought, I decided that the target price for Citigroup was not an event worth waiting for given that the profits would be marginal..

At first glance, it would seem that I should have made quite a tidy profit on Citigroup. But after examining it closer, the profits that I made were really peanuts. And this is largely due to the exchange rates.

Basically, I bought Citigroup when the USD (US dollar) to SGD (Singapore dollar) was around 1:1.4. The US dollar has however weakened significantly over the course of the years. So based on the exchange rate today, my profits were almost wiped out. You can take a look at the chart below to see how the USD has weakened significantly against the Singapore dollar.

At first glance, it would seem that I should have made quite a tidy profit on Citigroup. But after examining it closer, the profits that I made were really peanuts. And this is largely due to the exchange rates.

Basically, I bought Citigroup when the USD (US dollar) to SGD (Singapore dollar) was around 1:1.4. The US dollar has however weakened significantly over the course of the years. So based on the exchange rate today, my profits were almost wiped out. You can take a look at the chart below to see how the USD has weakened significantly against the Singapore dollar.

Man Stuck in Elevator for 40 Hours

In 1999, a man was stuck for close to 40 hours in an elevator. This time lapse video shows how he spent those 40 hours. Perhaps this was the time before hand phones became prevalent so he did not have one on him.

Debt Free!

So I sat down and worked out the numbers. Added up all my cash and liquid assets (i.e. stocks & unit trusts). Looking at the number, I suddenly realised its meaning. The number I was looking at was larger than the outstanding loans and debts that I have. In other words, if I were to liquidate all my shareholdings today and add that to the cash that is sitting around in the family's bank accounts, I will have sufficient money to pay off all my debts (e.g. housing loan, etc) right here, right now, with some cash left to spare. That means I can become debt free!!!!

This was perhaps never really a surprise to me. I sort of knew that God had blessed me with many good things. For one, I have enjoyed good health in my adult working life and was able to work almost continuously despite some job switches here and there. I am also a saver as I do not spend on unnecessary things. I eat at restaurants and stuff. But that is about all that I spend on. In my early years, I also managed to save quite a fair bit of money. God also has blessed me with some positive returns on my investments. So I sort of knew that I would become debt free much earlier than most people.

And yet, the realisation that I can be debt free does not necessarily mean that I want to be debt free right now. Having the money to pay off all my debts does not mean that I should go ahead and do so. After all, interest rates are very low here in Singapore. But then again, there is this difference between bad debt and good debt.

So the decision has come. Should I pay off all my loans and become debt free? Or should I continue to hold on to my debt and carry on investing? Decisions, decisions...

Anyway, to celebrate the occasion, I open a bottle of Hoegaarden (which reads original belgian wheat beer) to celebrate. And the next thing I do is to log into blogger to type this post and schedule it for publishing.

This was perhaps never really a surprise to me. I sort of knew that God had blessed me with many good things. For one, I have enjoyed good health in my adult working life and was able to work almost continuously despite some job switches here and there. I am also a saver as I do not spend on unnecessary things. I eat at restaurants and stuff. But that is about all that I spend on. In my early years, I also managed to save quite a fair bit of money. God also has blessed me with some positive returns on my investments. So I sort of knew that I would become debt free much earlier than most people.

And yet, the realisation that I can be debt free does not necessarily mean that I want to be debt free right now. Having the money to pay off all my debts does not mean that I should go ahead and do so. After all, interest rates are very low here in Singapore. But then again, there is this difference between bad debt and good debt.

So the decision has come. Should I pay off all my loans and become debt free? Or should I continue to hold on to my debt and carry on investing? Decisions, decisions...

Anyway, to celebrate the occasion, I open a bottle of Hoegaarden (which reads original belgian wheat beer) to celebrate. And the next thing I do is to log into blogger to type this post and schedule it for publishing.

Straits Times Index (STI) hits 5 Year High

So the Straits Times Index (STI) has hit its 5 year high of 3,301 points. Of course, it still has not reached its peak in Oct 2007 of 3,805 points. Will we even see such dizzying heights for the Singapore stock market again.

Well, nobody really knows the answer for sure. But with the US debt ceiling, Euro crisis and all other things that can happen along the way, one should continue to remain nimble.

A good question to ask yourself is this: How much more gains can you make in this bull run?

Well, nobody really knows the answer for sure. But with the US debt ceiling, Euro crisis and all other things that can happen along the way, one should continue to remain nimble.

A good question to ask yourself is this: How much more gains can you make in this bull run?

Sold Thakral and Saizen

After giving some thought, I decided to sell off my holdings in Thakral and Saizen. I bought these together with Lippo Malls Indonesia Retail Trust back in November 2012. You can see that posting I did here.

These are my entry prices and exit prices for the 3 stocks:

These are my entry prices and exit prices for the 3 stocks:

- Saizen (Entry=S$0.173; Exit = S$0.191)

- Thakral Corp (Entry=S$0.03; Exist = S$0.035)

- LMIR (Entry = $0.475; Exit = S$0.525)

There is really nothing to boast about my entry and exit prices. I am not a good market timer but generally, when the stock market goes up, almost every single stock goes up. So there is really nothing spectacular about my returns.

I know some of my previous posts about Thakral and Saizen might have been misleading as I was actually still thinking of loading up some more stocks yesterday and had written the posts earlier but scheduled it to be posted much later. However, after re-assessing my overall portfolio, I decided to liquidate more of my shareholdings so as to buffer up my cash position.

If you read my posting about "Bull Market or Prepare for Bear" as well as watched the video on Jeffrey Gundlach's market outlook, you will probably understand my rationale for selling. As they say, "Cash is King".

If you read my posting about "Bull Market or Prepare for Bear" as well as watched the video on Jeffrey Gundlach's market outlook, you will probably understand my rationale for selling. As they say, "Cash is King".

Saizen REIT - Dividends Declared But What Lies Ahead

So Saizen REIT has declared a half yearly distribution of 0.66 cents. Based on its share price of 19 cents, it gives a pretty good yield of close to 7%. Yes, this is a pretty high yield compared to other REITs listed on the Singapore stock exchange. You probably can't find yields like those in the US stock market too unless they are mortgage REITs.

Anyway, if you read one of my previous posts, you should know that Saizen is on my watchlist. (Okay, it is actually already in my stock portfolio but I am watching it to see if I should buy more).

Found this good video on Saizen. Any investor who wants to invest in Saizen should watch this video first as it gives a good overview of Saizen and its business and also explains why it probably trades at a discount to its net asset value. Here Mark Laudi interviews Raymond Wong (Executive Director at Saizen REIT). He asks him some tough questions that any investor should be asking.

Let me know what you all think about Saizen REIT..

Anyway, if you read one of my previous posts, you should know that Saizen is on my watchlist. (Okay, it is actually already in my stock portfolio but I am watching it to see if I should buy more).

Found this good video on Saizen. Any investor who wants to invest in Saizen should watch this video first as it gives a good overview of Saizen and its business and also explains why it probably trades at a discount to its net asset value. Here Mark Laudi interviews Raymond Wong (Executive Director at Saizen REIT). He asks him some tough questions that any investor should be asking.

Let me know what you all think about Saizen REIT..

Amy Winehouse - I'm No Good

I love this live version of I'm No Good that was sung by the late Amy Winehouse. Really has soul and there is something about her that makes her different from other singers. She is perhaps a true blue entertainer.

Unfortunately, her life ended while she was probably at the peak (or what could have possibly been the peak) of her career. If not for her dabbling in drugs. The video below is a sad reminder: If only she had gone to rehab.

Thakral Corporation Chart

I have bought and sold Thakral at various times since I started investing. Few months back, I entered into Thakral at S$0.03. Now that the price has risen to S$0.035, perhaps it is time for me to take profit? Including the dividends that were paid out, it is a tidy sum of money.

Outlook for 2013: Recap and Stock Take

This is a look at the various stocks that were previous listed in one of my previous postings on investment outlook and stock picks for 2013.

Most of the stocks have risen except for CMT, City Developments and UOB.

Most of the stocks have risen except for CMT, City Developments and UOB.

| Closing Price on 31 Dec 2012 | Closing Price on 8 Feb 2013 | |

| Biosensors | $1.205 | $1.330 |

| CMT | $2.130 | $2.130 |

| CMA | $1.940 | $2.100 |

| City Developments | $12.870 | $11.460 |

| DBS | $14.840 | $14.980 |

| Ezion Holdings | $1.690 | $1.805 |

| Keppel Corp | $11.000 | $11.530 |

| M1 | $2.710 | $2.740 |

| SembCorp Marine | $4.600 | $4.670 |

| Starhill Global REIT | $0.785 | $0.850 |

| UOB | $19.810 | $19.040 |

| Venture Corp | $8.060 | $8.480 |

| Capitaland | $3.700 | $3.860 |

| SIA Engineering Company | $4.390 | $4.740 |

| Pan United | $0.775 | $0.975 |

Beatrice Miller and Carly Rose Sonenclar at Bootcamp

Beatrice Miller and Carly Rose Sonenclar's performance at Bootcamp X Factor USA 2012. Both girls are really talented if you ask me. The song might actually have suited Beatrice's voice better though I think Carly sang it quite well too.