These are all random thoughts that I have been having the past few days. The first is really about my investing philosophy. I slowly come to realise that after reading so many books on investing, I am not really certain which school of thought I belong to.

Are markets efficient or are they inefficient? Should I just do index investing as suggested by gurus like Bogle or is it possible that one can actually find good stocks like Warren Buffett. And that is also about finding good stocks beyond what is considered luck or statistically insignificant results. But if you invest in the market index, then during the bear markets, it will also mean that you perform as badly as the entire stock market. And that by itself is a scary thought.

Another area is capital appreciation or dividends. Should I work towards building up a greater sum of capital first before going into dividend investing? Really mixed thoughts about this. For every attempt at capital appreciation, one is almost certain to introduce risks and possible losses to capital.

Is the bull market here to stay or is there going to be a coming collapse?

Will gold and silver continue to shine?

Will Greece still be in the Euro?

Will the US dollar continue to depreciate?

Is the US stock market rally justified by fundamentals? Or is it just another bubble?

When will the China bubble collapse?

Random thoughts in my head with no answers....

This blog is about financial freedom and serves to inform, educate and entertain the public on all personal finance matters. The author of this blog has been blogging for 5 over years. He was also a guest blogger at CPF's IMSavvy site (now AreYouReady site). This blog is visited by many unique readers from various countries every month. Do bookmark this blog and leave your comments.

Do You Know What Are Home Loan Consultancy Sites?

By Property Buyer

Working procedures of online home loan consultancy in Singapore:

1. What do mortgage consultants do?

Home loan consultants work by providing the requirements and information about the home loan packages offered by different banks in the country. They act like a medium between you and the financial institution which will provide your home loan.

In the beginning, they will take your overall details and assess your financial profile to suggest the most suitable home loan as they are knowledgeable about all the different Singapore home loans available.

Home loan consultants provide this free service as they are paid a percentage of the loan amount from the bank itself.

The banks in Singapore maintain this relationship with home loan consultants because they get to save on sales staff.

2. Different online home loan packages

Some of the home loan consultancy sites offer you different comparison tools to compare the home loan packages from different banks , or the same bank. I have a great exemplary site which can provide you this service apart from the usual mortgage advisory services.

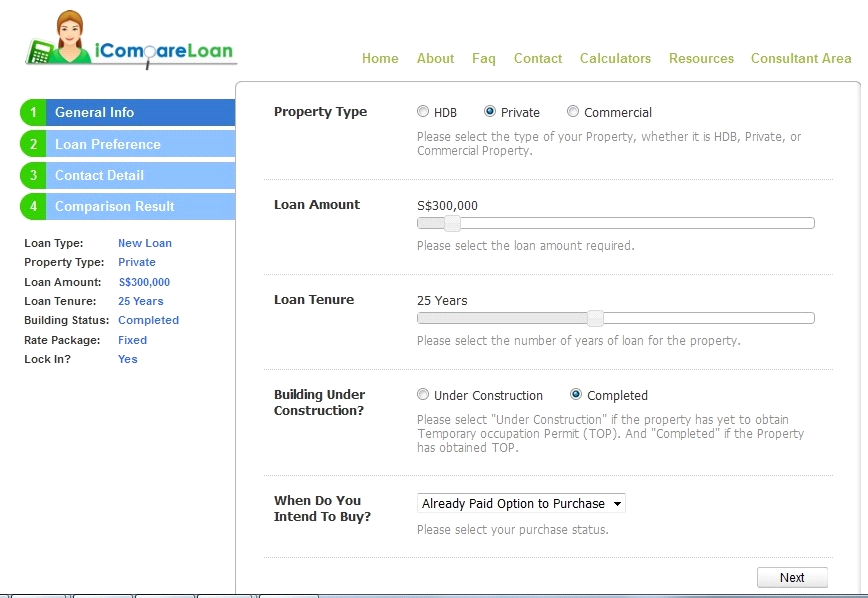

The home loan comparison system at iCompareLoan.com perform that in 4 easy steps only. Before that, you need to provide some important information such as:

- Quantum

- Duration

- Type (fixed or floating rate)

The whole process is illustrated in figure 1 and figure 2 as follows:

Source: www.iCompareLoan.com/new_loan

3. Desired reports for your home loan

Figure 1: Step 1 of Loan Comparison System

Source: www.iCompareLoan.com/new_loan

Figure 2: Step 4 of Loan Comparison System

Source: www.iCompareLoan.com/new_loan

3. Desired reports for your home loan

A home loan report shows the comparative information about the different Singapore home loans formalities and requirements for different banks of Singapore. These reports are provided by a few home loan consultancy sites like iCompareLoan.com , which offers a loan analysis system. This service is almost free or given for a small fee and it is the most advanced in Singapore. This analytical system can generate very helpful reports by comparing many home loan packages. In these reports there are included various information such as interest cost savings from refinancing or new loans, building-under-construction loans, amortization tables, and so on.

You can see the log-in page in Figure 3:

Figure 3: Loan Analysis System

Source: www.iCompareLoan.com/consultant/

Benefits of home loan consultancy sites:

1. Save time and effort

How can home loan consultancy sites make life different for you? The answer is that they can save you valuable time and effort. In Singapore there are over 16 banks that can provide a mortgage. Together they have almost 50 types of loan packages to offer. Now, if you are thinking about inquiring each and every home loan package then you have to visit each bank website. But, more often than, you will not be able to find the most basic information about the loan on these sites. Not even the interest rates or the lock-in period.

Rather these sites will direct you to their bank officers for further details ; thus you have to speak with over 10 officers to find the most suitable mortgage. In this case, home loan consultancy sites can help you sift through all the packages and compare their features in easy-to-read tables.

Through the free DIY loan comparison tools, provided by consultancy sites as well as by iCompareloan.com , you can generate tables comparing the main features of various loan packages. This can be achieved with only a few simple steps saving you plenty of time and effort.

For more comprehensive advice you can contact the mortgage consultants as the loan packages and their features can change ever so often.

For a borrower it can be difficult to be constantly aware of all the changes. A mortgage consultant, on the hand, is well aware of all the changes as it is his job.

2. Unbiased loan advice

Before you decide to take a mortgage from any bank you need unbiased advice about the offers of different banks. This information can only be provided by mortgage consultants as they are not beholden to any single bank. On the other hand, if you seek advice from a bank officer he will try to convince you about the merits of the loans offered by his bank. He also cannot provide you with information about other banks' loans.

So, the best advisors are the mortgage consultants who know enough to provide information.

3. Extra assistance

Home loan consultants not only can provide you with information about the various different loans, but they can even assist to make an application for your desired mortgage. They are happy to assist you in putting in order the required documents for the loan application. As the paperwork can take up a lot of time so your loan application can be delayed too.

When the loan amount is over $2 million, mortgage consultants can even negotiate a good interest rate during the approval process.

About Property Buyer

http://www.PropertyBuyer.com.sg/mortgage

We are a research-focused Singapore mortgage consultancy which helps you compare Singapore home loans either for new loans or refinancing. We use loan reports from Singapore's best loan analysis system (exclusive to us) at http://www.icompareloan.com/consultant/ to serve our customers.

Our services are completely FREE to you as the banks pay us a referral fee upon loan disbursement.

SMS: (65) 9782 8606

Email: loans@PropertyBuyer.com.sg

Join us at Facebook:

www.facebook.com/iCompareLoans

www.facebook.com/SGpropertyBuyer

www.facebook.com/sghomeloan

Simply Bread Breakfast

Breakfast was at Simply Bread again. It was a rather relaxing day with little appointments to keep up with so there was time for a nice and slow meal. Tucked away between 5th Avenue and 6th Avenue, the location is perfect. Not too far flung yet secluded enough and away from the crowds. A respite from your usual shopping malls.

The crowd is a mixture of Caucasians and Singaporeans (or Asians). Everybody seems to be ordering 2 Eggs but that is not what I ordered. French Toast with Ham Steaks is on my mind.

Their french toast is not your typical thin sliced bread soaked in egg mixture. It is something I haven't tried elsewhere.

The ham steaks are as always - GOOD. Comfort food at its best. Thick slices of honey baked ham with some honey drizzled over it. Well, that set me back by ten dollars and cents thirty-five (GST not included). But whose counting?

And the meal was made complete with the usual cup of coffee and milk. =)

The crowd is a mixture of Caucasians and Singaporeans (or Asians). Everybody seems to be ordering 2 Eggs but that is not what I ordered. French Toast with Ham Steaks is on my mind.

Their french toast is not your typical thin sliced bread soaked in egg mixture. It is something I haven't tried elsewhere.

The ham steaks are as always - GOOD. Comfort food at its best. Thick slices of honey baked ham with some honey drizzled over it. Well, that set me back by ten dollars and cents thirty-five (GST not included). But whose counting?

And the meal was made complete with the usual cup of coffee and milk. =)

Aston Martin V12 Vantage

Top Gear tests drives the Aston Martin V12 Vantage. It goes from 0 to 60 miles in 4 seconds. While it looks like the V8 Vantage, it is really a lot more powerful.

Dividends and Passive Income for Jan and Feb 2013

I have been keeping a very bad record of my dividends/passive income. But here it is so that I do not forget:

Jan 2013: $111.80

Feb 2013: $287.46

Main contributors were from Armour Residential REIT (ARR), GAMCO Gold and Natural Resources Trust (GGN), and Starhill Global REIT.

I have also liquidated quite a few of my stocks. On the back of STI hitting its 5 year high, I have sold off all my holdings in Ascott REIT, Saizen REIT, LMIR, Thakral, Nam Cheong and Citigroup.

Jan 2013: $111.80

Feb 2013: $287.46

Main contributors were from Armour Residential REIT (ARR), GAMCO Gold and Natural Resources Trust (GGN), and Starhill Global REIT.

I have also liquidated quite a few of my stocks. On the back of STI hitting its 5 year high, I have sold off all my holdings in Ascott REIT, Saizen REIT, LMIR, Thakral, Nam Cheong and Citigroup.

Poor People in Singapore

There are poor people in Singapore. The poor are really poor and the rich are really rich. And the divide is probably getting larger. The median monthly household income from work amongst resident employed household for year 2012 was S$7,570. This includes employer Central Provident Fund contributions. Based on statistics, there are 9.2% of households with no working persons, of which, 6.0% of these are retiree households.

I have become more aware of the poor around us. At least to me, I have been noticing that there are more and more people walking (or standing) around selling tissue papers. Well, they are not really selling tissue papers are they? Some of them just place the tissue papers on your table while you are eating and ask you for money. They are almost literally begging for money. The selling of tissue paper is just a "cover". After all, begging is illegal in Singapore(?).

One also notices that there are people who are selling tissue papers outside supermarkets, grocery stores, etc. Anybody in need of a tissue paper can easily pop into one of those stores to buy themselves all the tissue they need. But yet, it is not uncommon to see people stopping to buy tissue paper from these poor people who peddle their wares.

It is also increasingly common to see homeless people sleeping around in the void decks or at various places in Singapore. Well, these people might not be homeless. But nobody really knows. And nobody bothers to ask.

Just today, I witnessed a woman go up to some diners to ask for money to buy food. It might come as a surprise to some but I have actually seen people eating left over food on the tables as well as from the dustbins. Yes, we can dismiss them as perhaps mentally unsound. But perhaps the reason is that they are really poor.

There is also this struggle within me about how to help the poor. I struggle with it every now and then. Surely change must begin with me. But there are limits to how much I can do. Or perhaps, these are just my excuses.

I have become more aware of the poor around us. At least to me, I have been noticing that there are more and more people walking (or standing) around selling tissue papers. Well, they are not really selling tissue papers are they? Some of them just place the tissue papers on your table while you are eating and ask you for money. They are almost literally begging for money. The selling of tissue paper is just a "cover". After all, begging is illegal in Singapore(?).

One also notices that there are people who are selling tissue papers outside supermarkets, grocery stores, etc. Anybody in need of a tissue paper can easily pop into one of those stores to buy themselves all the tissue they need. But yet, it is not uncommon to see people stopping to buy tissue paper from these poor people who peddle their wares.

It is also increasingly common to see homeless people sleeping around in the void decks or at various places in Singapore. Well, these people might not be homeless. But nobody really knows. And nobody bothers to ask.

Just today, I witnessed a woman go up to some diners to ask for money to buy food. It might come as a surprise to some but I have actually seen people eating left over food on the tables as well as from the dustbins. Yes, we can dismiss them as perhaps mentally unsound. But perhaps the reason is that they are really poor.

There is also this struggle within me about how to help the poor. I struggle with it every now and then. Surely change must begin with me. But there are limits to how much I can do. Or perhaps, these are just my excuses.

Make Their Wishes Come True

Dear Readers,

Have started a donation campaign to raise $10,000 for Make A Wish Foundation. Make A Wish Foundation (Singapore). The target is $10,000 to be achieved by the end of this year.

For those who might not know, make a wish foundation tries to fulfil the wishes of children who suffer from life-threatening medical conditions. Think of what you can do just to put a smile on their faces.

If you have enjoyed reading this blog in one way or another, please make a little donation to support this worthy cause. Any small amount, no matter how little, will do.

Thank you.

Have started a donation campaign to raise $10,000 for Make A Wish Foundation. Make A Wish Foundation (Singapore). The target is $10,000 to be achieved by the end of this year.

For those who might not know, make a wish foundation tries to fulfil the wishes of children who suffer from life-threatening medical conditions. Think of what you can do just to put a smile on their faces.

If you have enjoyed reading this blog in one way or another, please make a little donation to support this worthy cause. Any small amount, no matter how little, will do.

Thank you.

Subscribe to:

Posts (Atom)

Featured Post

Unlock Exclusive Deals and Savings: Join Amazon Prime Today!

Amazon is celebrating Prime members with a multitude of deals during Prime Day. The event will offer more deals than ever before, with new d...

-

Civil servants or public officers in Singapore are expected to declare their financial standing when they first join and every year thereaft...

-

Trying to compile the salary pay scale for the Singapore civil service. Somehow, I only managed to find the figures for 2011. There are p...

-

In my previous article , I compared an endowment plan with an ILP. Many might think that an ILP is a silly way to save for my child's ed...

-

Everybody loves free stuff. So as part of the Christmas Celebrations, I am giving away MONEY! ANYONE can earn it. Just leave a comment on th...

-

Not too long ago, I wrote a post about how much to give for Chinese wedding dinners. It was pretty well received so I thought a good fo...

-

Many young graduates who are seriously considering joining the civil service are likely curious to find out what is the starting pay or sala...

-

“We are more than that; we are in the business of creating time.” - Tay Liam Wee Mr Tay Liam Wee has an estimated networth of around S$135m....

-

Here are some frequently asked questions about sgfinancialfreedom: Q: How do you compute your networth? A: I compute my networth by adding m...

-

How much does a normal or average Singaporean earn? Based on median income, that is supposed to be $2,400 per month and raised to over $300...

-

Networth as of Feb 2010 is estimated around $652,000. A slight drop from Jan 2010. The decline in networth was due to a slight drop in my ...