By Property Buyer

Working procedures of online home loan consultancy in Singapore:

1. What do mortgage consultants do?

Home loan consultants work by providing the requirements and information about the home loan packages offered by different banks in the country. They act like a medium between you and the financial institution which will provide your home loan.

In the beginning, they will take your overall details and assess your financial profile to suggest the most suitable home loan as they are knowledgeable about all the different Singapore home loans available.

Home loan consultants provide this free service as they are paid a percentage of the loan amount from the bank itself.

The banks in Singapore maintain this relationship with home loan consultants because they get to save on sales staff.

2. Different online home loan packages

Some of the home loan consultancy sites offer you different comparison tools to compare the home loan packages from different banks , or the same bank. I have a great exemplary site which can provide you this service apart from the usual mortgage advisory services.

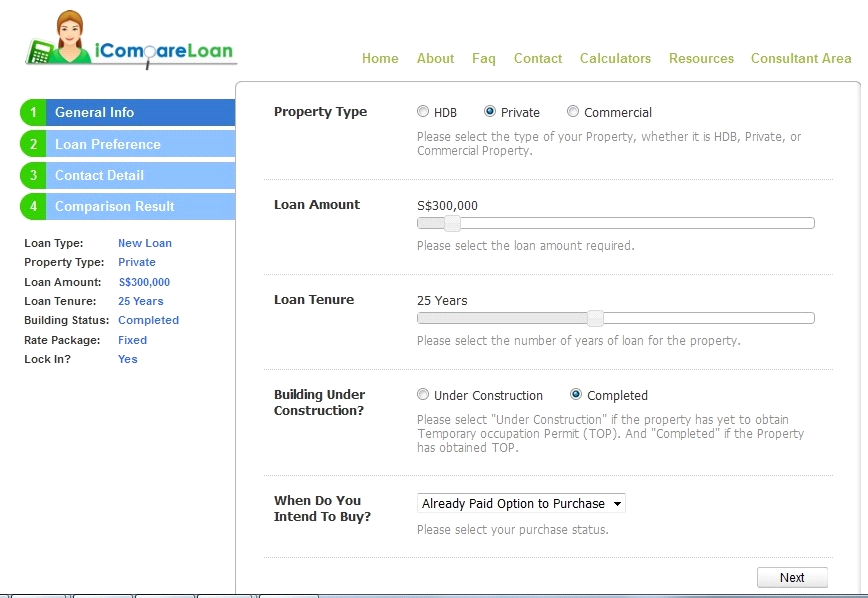

The home loan comparison system at iCompareLoan.com perform that in 4 easy steps only. Before that, you need to provide some important information such as:

- Quantum

- Duration

- Type (fixed or floating rate)

The whole process is illustrated in figure 1 and figure 2 as follows:

Source: www.iCompareLoan.com/new_loan

3. Desired reports for your home loan

Figure 1: Step 1 of Loan Comparison System

Source: www.iCompareLoan.com/new_loan

Figure 2: Step 4 of Loan Comparison System

Source: www.iCompareLoan.com/new_loan

3. Desired reports for your home loan

A home loan report shows the comparative information about the different Singapore home loans formalities and requirements for different banks of Singapore. These reports are provided by a few home loan consultancy sites like iCompareLoan.com , which offers a loan analysis system. This service is almost free or given for a small fee and it is the most advanced in Singapore. This analytical system can generate very helpful reports by comparing many home loan packages. In these reports there are included various information such as interest cost savings from refinancing or new loans, building-under-construction loans, amortization tables, and so on.

You can see the log-in page in Figure 3:

Figure 3: Loan Analysis System

Source: www.iCompareLoan.com/consultant/

Benefits of home loan consultancy sites:

1. Save time and effort

How can home loan consultancy sites make life different for you? The answer is that they can save you valuable time and effort. In Singapore there are over 16 banks that can provide a mortgage. Together they have almost 50 types of loan packages to offer. Now, if you are thinking about inquiring each and every home loan package then you have to visit each bank website. But, more often than, you will not be able to find the most basic information about the loan on these sites. Not even the interest rates or the lock-in period.

Rather these sites will direct you to their bank officers for further details ; thus you have to speak with over 10 officers to find the most suitable mortgage. In this case, home loan consultancy sites can help you sift through all the packages and compare their features in easy-to-read tables.

Through the free DIY loan comparison tools, provided by consultancy sites as well as by iCompareloan.com , you can generate tables comparing the main features of various loan packages. This can be achieved with only a few simple steps saving you plenty of time and effort.

For more comprehensive advice you can contact the mortgage consultants as the loan packages and their features can change ever so often.

For a borrower it can be difficult to be constantly aware of all the changes. A mortgage consultant, on the hand, is well aware of all the changes as it is his job.

2. Unbiased loan advice

Before you decide to take a mortgage from any bank you need unbiased advice about the offers of different banks. This information can only be provided by mortgage consultants as they are not beholden to any single bank. On the other hand, if you seek advice from a bank officer he will try to convince you about the merits of the loans offered by his bank. He also cannot provide you with information about other banks' loans.

So, the best advisors are the mortgage consultants who know enough to provide information.

3. Extra assistance

Home loan consultants not only can provide you with information about the various different loans, but they can even assist to make an application for your desired mortgage. They are happy to assist you in putting in order the required documents for the loan application. As the paperwork can take up a lot of time so your loan application can be delayed too.

When the loan amount is over $2 million, mortgage consultants can even negotiate a good interest rate during the approval process.

About Property Buyer

http://www.PropertyBuyer.com.sg/mortgage

We are a research-focused Singapore mortgage consultancy which helps you compare Singapore home loans either for new loans or refinancing. We use loan reports from Singapore's best loan analysis system (exclusive to us) at http://www.icompareloan.com/consultant/ to serve our customers.

Our services are completely FREE to you as the banks pay us a referral fee upon loan disbursement.

SMS: (65) 9782 8606

Email: loans@PropertyBuyer.com.sg

Join us at Facebook:

www.facebook.com/iCompareLoans

www.facebook.com/SGpropertyBuyer

www.facebook.com/sghomeloan